higher return – less risk – lower costs

We develop rule-based investment strategies that outperform the market in the long term. We apply exclusively scientific models whose success has been documented in numerous studies.

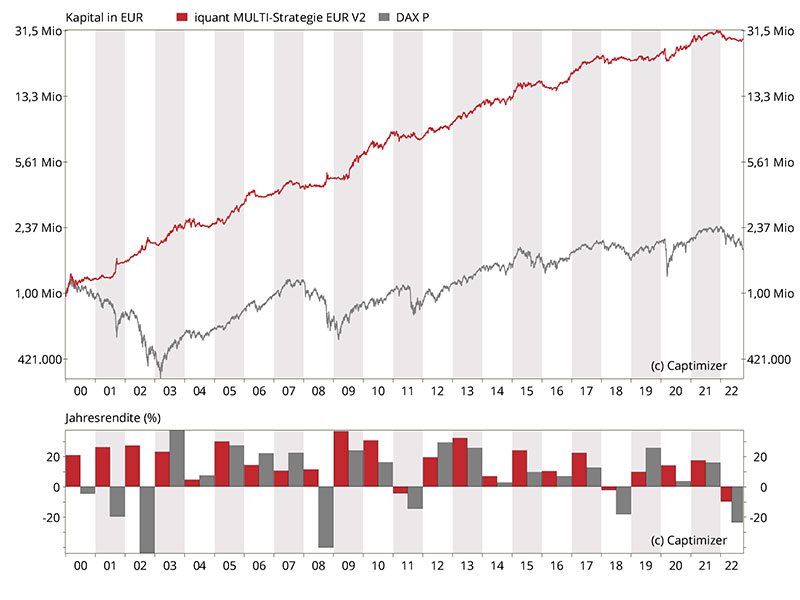

| iq MULTI-Strategy EUR | DAX® Performance Index | ||

| Return p.a. (geo.): | 16.72 % | vs. | 2.60 % |

| 2021 Return: | 16.55 % | vs. | 15.79 % |

| 2022 Return YTD: | -9.64 % | vs. | -23.74 % |

| Maximum loss: | -15.31 % | vs. | -72.68 % |

| Volatility p.a.: | 11.66 % | vs. | 20.47 % |

| Longest bear market: | 1.46 years | vs. | 7.31 years |

This umbrella strategy combines dividend, momentum, trend following and seasonal approaches. Two methods are applied for the selection of high-dividend DAX® shares along with two strategies for the momentum-based selection of shares from the HDAX®.

Based on a trend following strategy, the portfolio is topped off with securities selected from the NASDAQ100®, with the addition of two seasonal DAX® and MDAX® timing strategies. All strategies invest either directly in shares or ETF. Some strategies are based on falling stocks, implemented by using a short ETF with no leverage.

Applicable to portfolios over EUR 250.000 and above.

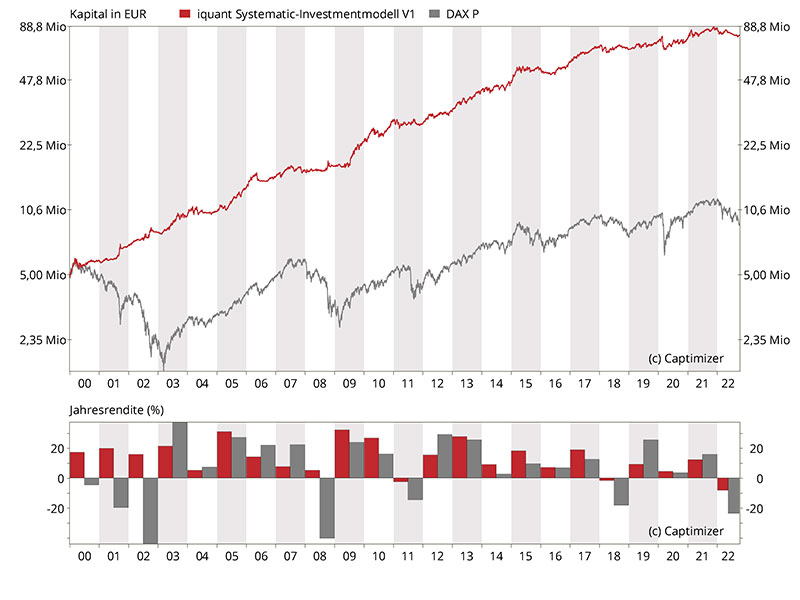

| iq Systematic-Investment EUR | DAX® Performance Index | ||

| Return p.a. (geo.): | 12.96 % | vs. | 2.60 % |

| 2021 Return: | 12.28 % | vs. | 15.79 % |

| 2022 Return YTD: | -8.23 % | vs. | -23.74 % |

| Maximum loss: | -14.57 % | vs. | -72.68 % |

| Volatility p.a.: | 9.34 % | vs. | 20.47 % |

| Longest bear market: | 1.49 years | vs. | 7.31 years |

This strategy is an expanded version of iquant MULTI, which additionally invests in the MSCI World, MSCI Emerging Markets and Gold.

Applicable to portfolios over EUR 2m and above.

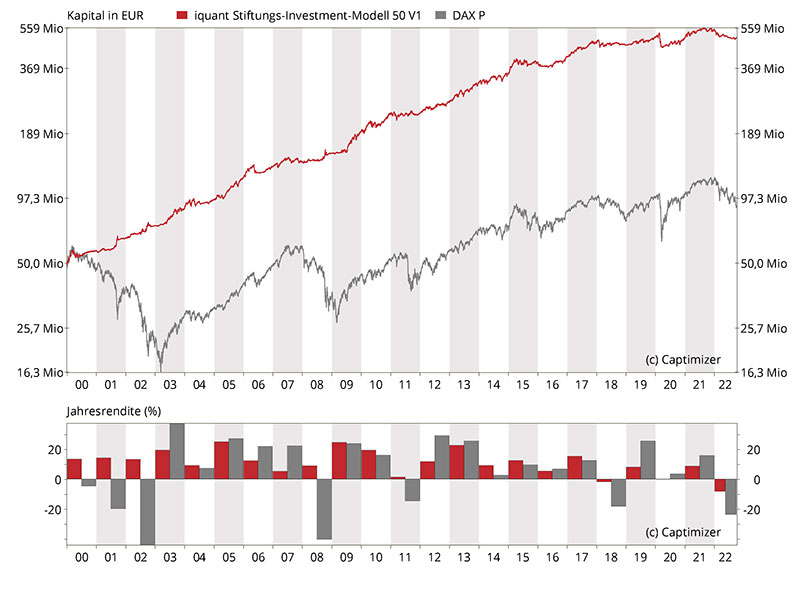

| iq Foundation-Investment-Modell 50 V1 | DAX® Performance Index | ||

| Return p.a. (geo.): | 10.69 % | vs. | 2.60 % |

| 2021 Return: | 8.67 % | vs. | 15.79 % |

| 2022 Return YTD: | -8.22 % | vs. | -23.74 % |

| Maximum loss: | -14.03 % | vs. | -72.68 % |

| Volatility p.a.: | 7.20 % | vs. | 20.47 % |

| Longest bear market: | 1.67 years | vs. | 7.31 years |

This strategy is a highly advanced form of iq Systematic and has been developed to manage a large fund of assets. It can also be used for the management of a mutual fund.

Applicable to portfolios over EUR 50m and above.

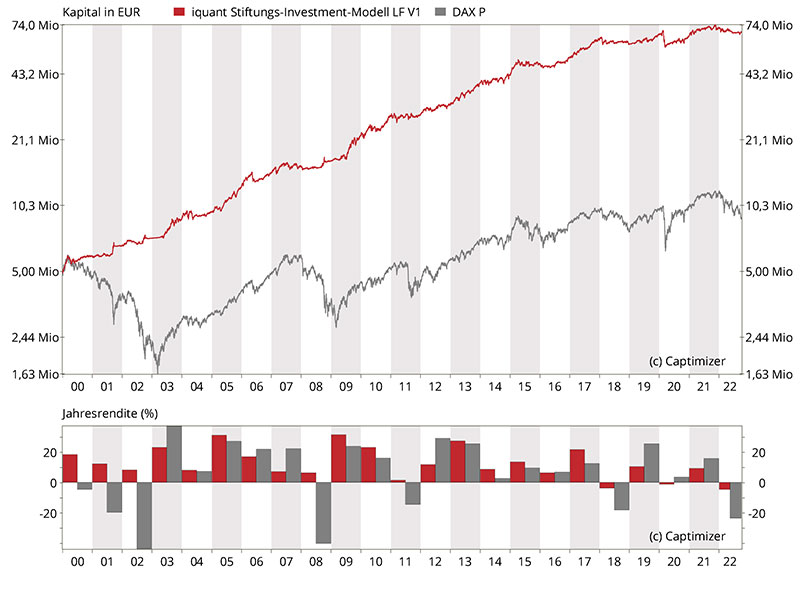

| iq Foundation-Investment-Modell LF V1 | DAX® Performance Index | ||

| Return p.a. (geo.): | 12.16 % | vs. | 2.60 % |

| 2021 Return: | 9.31 % | vs. | 15.79 % |

| 2022 Return YTD: | -4.76 % | vs. | -23.74 % |

| Maximum loss: | -16.58 % | vs. | -72.68 % |

| Volatility p.a.: | 8.52 % | vs. | 20.47 % |

| Longest bear market: | 1.80 years | vs. | 7.31 years |

This strategy was developed with the goal of minimizing the number of transactions, yet with a similar risk / reward profile to the underlying iq Foundation investment strategy.

Applicable to portfolios over EUR 5m and above.

scientific – innovative – leading in technology

Algorithms will increasingly control professional portfolio management in the future. iquant, developer of efficient and reliable solutions, is a pioneer of this technology.

contact

Contact us for more information on quantitative asset management and automated investment solutions. You may communicate with us in English or German.

iquant GmbH

Bahnhofsstrasse 9

CH 6340 Baar

Schweiz

E-Mail: info@iquant.ch